Taking a break from our usual blog formatting, today we’re releasing a special Q&A interview with Jason Smith, VP of Business Development at Fundbox. We’ve had a lot of great feedback from our Community over our recent whitepaper on the Net Terms Economy, so the Oro team took the opportunity to deep-dive further into this topic by asking Jason for his expert advice on one of the latest trends in the B2B payment industry.

We hope you enjoy this informative Q&A!

Background

Oro: I’d love to first dive a little bit into your background. You’ve worked in several strategic capacities across PayPal for many years, including business development roles for major companies, such as Paypal and X.Commerce (a division of eBay) to develop overall business strategies for global expansion and revenue growth. Now you’re in a relatively new role at Fundbox working to scale the business to a global level.

Given your background, can you give a brief overview of the Fundbox platform and how your previous experience has influenced your current role?

Jason: Absolutely. For those that might not be familiar, Fundbox is a financial technology (Fintech) company that has built the first B2B payments and credit network designed to accelerate B2B commerce at scale. If I were to boil down what our team at Fundbox does, I would say that we’re committed to helping B2B businesses pay or get paid faster, by using advanced machine learning to assess credit risk and then, for approved businesses, we provide access to credit on-demand. We’re intent on bringing a B2C transaction experience to the world of B2B.

Here’s why this is important…

There’s almost no business in the U.S., regardless of age, size, industry or location, that hasn’t been challenged at some point in time, to maintain a steady cash flow while waiting for outstanding invoices to get paid. And conversely, businesses that rely on some form of payment financing (trade credit or net terms) in order to purchase their inventory upfront, are clamoring for faster credit decisions and more flexible terms so they can purchase more quickly and then have greater flexibility to pay over time.

The way in which businesses buy and sell between one another needs to evolve if they’re going to keep up with the rapid pace of digital commerce. And, that’s why Fundbox exists.

This is a great segue to tell you a bit more about my background.

Before joining Fundbox, I was at PayPal for 13 years where I led global channel sales and business development. My time there gave me a great front-row seat to watch the evolution of B2C payments which PayPal has more or less defined.

It was during these years that I not only learned what consumers wanted from their payment experiences but also what businesses wanted when transacting with each other as well. As consumers, we’ve all benefited by the years of investment in technologies made by PayPal, Visa, American Express, Mastercard that have made B2C transactions a fast, convenient, seamless and transparent experience.

And yet, B2B transactions have not evolved at the same pace as B2C, which is what led me to join Fundbox. I understood the challenge but, more importantly, I saw a very real opportunity to change the status quo in the way B2B businesses pay or get paid. It’s not often that you have the opportunity to address such an enormous need so early on in the game.

Fundbox is well-positioned to be the dominant player in B2B payments and credit space, much like PayPal has been in the world of B2C transactions. I am very excited to be part of the team that is driving true business transformation.

Challenges of Acquiring Funding Through Traditional Means

Oro: It’s tough launching a business from scratch and it can be even tougher to reach a point of steady, predictable cash flow. Many business owners take out traditional bank loans, apply for a line of credit, access merchant cash advances, or borrow from friends and family in order to help cover expenses like renovations or project costs. Can you share some of the challenges or pitfalls of these financing options?

And what are some of the benefits of these traditional financing options, if approved?

Jason: The first thing to know is that businesses use credit for all kinds of things ranging from startup funding to filling in cash flow gaps when sales are slow or when invoices are paid late. And, because the need for credit is usually time-sensitive, frustration grows when the application process for a line of credit or loan is time-consuming, complicated and slow.

Having to wait for a credit decision means that you may be forced to put off important business decisions that are tied to credit approval. All business owners know that waiting (for a credit decision) works against you when you’re trying to close a deal or make a much-needed purchase.

Instead, many business owners opt to “bootstrap” their finances by going to family and friends or by liquidating personal assets. And then, once you’re up and running, the next battle you face is to modulate your cash flow in order to keep it steady and consistent. This is where services like merchant cash advances or payday loans start to show up. These sorts of financial tools can be used to fill in cash gaps while waiting for outstanding invoices to be paid.

However, anytime a business takes out credit to triage their cash flow, they run the risk of getting into deeper financial issues such as “loan stacking” which, is when you take out multiple loans with the intention of using one to pay off the other.

Sometimes needing credit can be a symptom to a bigger issue, one of which could be the lack of predictable cash flow. With many businesses, it’s hard to forecast if or when your customers will pay you on time, despite clear agreement on net terms.

For example, if you’re a B2B seller you may struggle with getting your customers to pay on time because they might have their own cash flow disruptions. And then, you add the fact that by offering net terms, you’re essentially locking up your own cash flow for 30, 60, 90 and in some cases 120 days. This puts the business owner “between a rock and a hard spot” as their tying up their cash flow that’s compounded by customers paying late. It’s this coalesce of events that trigger the search for credit as a safety net.

At the end of the day bank loans, lines of credit, merchant cash advances and other credit-related services are there because business owners need access to credit for a variety of reasons.

At Fundbox, we’re here to help optimize the way business funds flow so businesses get paid faster or can pay for their purchase faster. In either case, we’re here to make access to credit simple, fast, transparent and ideally, more predictable. If we’re successful in our mission then over time, we hope to change the mindset of thinking about credit as a safety net to instead thinking about credit as a growth catalyst.

Defining the Net Terms Economy

Oro: Oro has partnered with Fundbox to publish a new whitepaper that was recently released titled “The New Net Terms Economy.” In this whitepaper, you’ve coined a new term called “Net Terms Economy.”

Can you define Net Terms Economy and how has the popularity of B2B eCommerce affected it?

Jason: Of course! We coined the term “Net Terms Economy” after completing a research study in partnership with one of our industry’s leading media outlets, PYMNTs, earlier this year. And, I have to say that the results were eye-opening.

We found that there is an astonishing $3.1 trillion or 17% of the U.S. GDP owed to U.S. firms that are locked up in accounts receivables “limbo” as outstanding invoices. With the sheer size of this out-of-reach pool of capital, we can assume that almost every business in the U.S. has some amount of cash flow tied up in this economy. Either as a seller providing net terms or as a buyer that relies on net terms so they can pay for their purchases over time.

For years, the status quo in the way businesses transact with each other, has disrupted cash flow and made the predictability of payments, challenging. And for businesses that rely on net terms from their suppliers, there is the constant worry that there won’t be enough time to pay off their terms in a timely fashion. This has been the default way to conduct business but, it doesn’t have to be this way moving forward.

With new open sources of data, advancements in machine learning and data science, a business like Fundbox can not only optimize but also accelerate the way business funds flow.

This means that sellers no longer have to wait to get paid. Imagine no more accounts receivables? And for buyers, they now have more flexible repayment terms that work best for their business needs without putting undue stress on their cash flow. This is why it’s been so exciting to work at Fundbox because we’re actually unlocking access to the Net Terms Economy using machine learning to drive faster payments and fact access to business credit.

Oro: The main philosophy behind trade credit is “buy now, pay later.” With that philosophy, what incentive would a buyer ever have to pay on time?

Jason: This is a great question. Most buyers that apply for net terms do so because they don’t have the cash upfront and they want the ability to modulate their cash flow by spreading out payments. So not paying right away works to their advantage. But, this strategy doesn’t necessarily win over their suppliers who end up compromising their own cash flow to accommodate the needs of their customers.

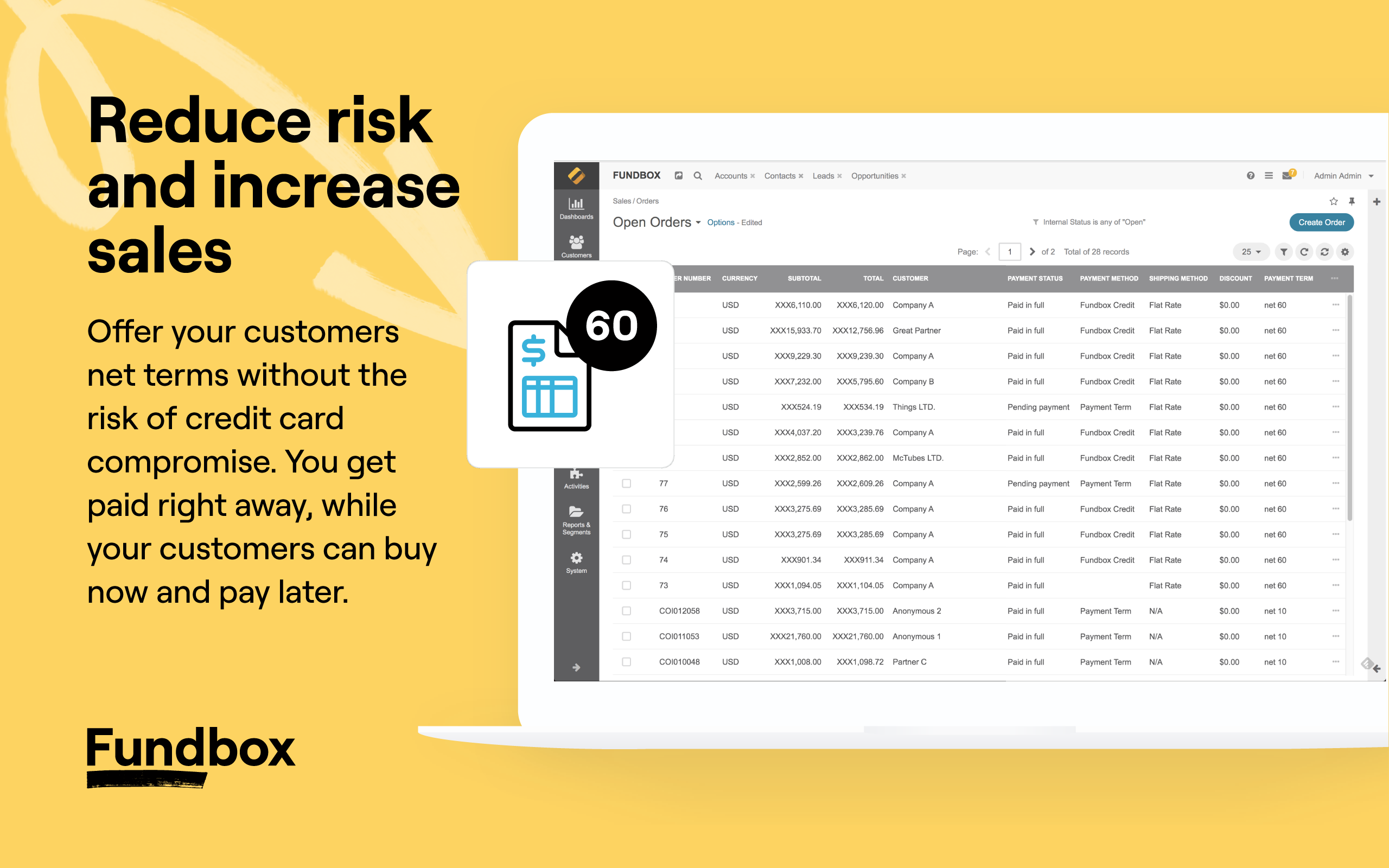

However, neither side has to be at a disadvantage, because we have both knowledge and technology to make a B2B transaction, mutually beneficial. We’ve created a data-centric platform that enables buyers to continue to pay over time with greater flexibility, and we can pay sellers right away. At Fundbox, we believe there’s tremendous value in creating a “win/win” solution so that each side of the transaction gets what they need when they need it the most.

Oro: As B2B commerce has digitally evolved towards B2B eCommerce, how has a shift in technology affected how B2B businesses operate with funding and managing business loans?

Jason: In a pre-Fintech world, and even to some extent today, your average B2B commerce experience is unfortunately too slow and laborious. For example, you might have a procurement person going to a supplier’s portal to look at inventory, pricing and then having to submit a purchase order via email, fax or an order capture system. Once that order is received, the supplier’s accounting or risk department would need to run a credit application on the potential buyer in order to determine if the business is qualified to receive net terms. If the applicant is approved, then the next step would be to negotiate terms.

Not only is this process time-consuming both for the supplier and the buyer, but it also won’t scale to meet the needs of a global e-commerce buying audience. This is an important point to make, that without fast and accurate risk assessment at scale, B2B businesses will not be able to reap the same benefits of e-commerce in the way that B2C businesses have.

What B2B businesses need is a unified payment and credit platform that analyzes risk provides on-demand access to capital paying sellers right away and providing buyers with more flexible terms. That pretty much sums up Fundbox. We’ve created this solution that meets all of buyer and seller transaction requirements with the goal of transforming the way all businesses transact online.

Oro: Companies like Fundbox are relatively new in the payment industry. How has Fundbox’s solution to the Net Terms Economy dilemma help facilitate B2B payments and give B2B businesses access to capital?

Jason: We’ve been analyzing the way businesses transact with one another since the company’s inception and, what we found is that B2B businesses would like to transact as fast and efficiently as their B2C counterparts. No surprise there. And yet, unlike the world of B2C that’s benefited from payment networks like Visa or American Express, there’s been very little innovation to accelerate B2B payments or enable faster access to business credit.

And that’s what we’re working on to change.

In order for B2B businesses to transact like B2C businesses with their customers, three critical factors need to be addressed at the same time.

The first factor is to assess credit risk. When an unknown buyer comes to a supplier for the first time and is asking for terms, it is the credit risk analysis by the seller that determines if the buyer is eligible for net terms.

As mentioned previously, this process of assessing credit risk has historically been cumbersome and slow, forcing both the seller and the buyer to wait. And, at the end of this process, there’s no guarantee that the buyer will be approved. And in that case time, resources and opportunity are wasted. Fortunately, with new advances in machine learning, we are able to asses credit risk in as little as a few minutes. This enables both the seller and the buyer to quickly know the buyer will be qualified for net terms.

The second factor that needs to be addressed is that business credit should be made available to buyers faster so they can complete their transactions and then quickly move on to the next task on their list. And, if we address risk quickly, then there’s no reason why buyers couldn’t have more flexible terms to work best with their cash-flow considerations. This is a powerful combination because it gives buyers greater financial agility for purchasing and repayment.

The last factor to address is the speed at which we pay sellers. With machine learning-enabled credit risk addressed and faster access to credit for approved buyers, there’s no reason not pay the B2B seller right away. For a fee starting at 1.75%, much like merchants pay to a credit card provider, B2B sellers can get paid as soon as the next business day once the transaction is accepted by the buyer. That means that the money sellers have tied up in accounts receivables, becomes available. Imagine how getting paid right away would enable businesses to focus on growth instead of just treading water.

It’s the combination of these three things that is the key to unlocking the Net Terms Economy and driving real business transformation.

The Evolution of Moving into the Digital Era

Oro: What advice do you have for more traditional companies who might be more reluctant to adopt newer technology or are hesitant to change the way they do business?

Jason: Being good at business means that you have the ability to adapt to change. It’s clear that more and more businesses want to transact online and to do it in a way that opens up new opportunities.

To not recognize or react to this change means that you could become a business laggard before you know what’s happening. Traditional businesses don’t need to adopt the newest application or service right away but, at the very least, they should be aware of how their own market segment is responding to customer demands. If customers want faster payment or access to credit, then it’s incumbent on the business owner to satisfy the needs of their customers if they want to stay in business long-term.

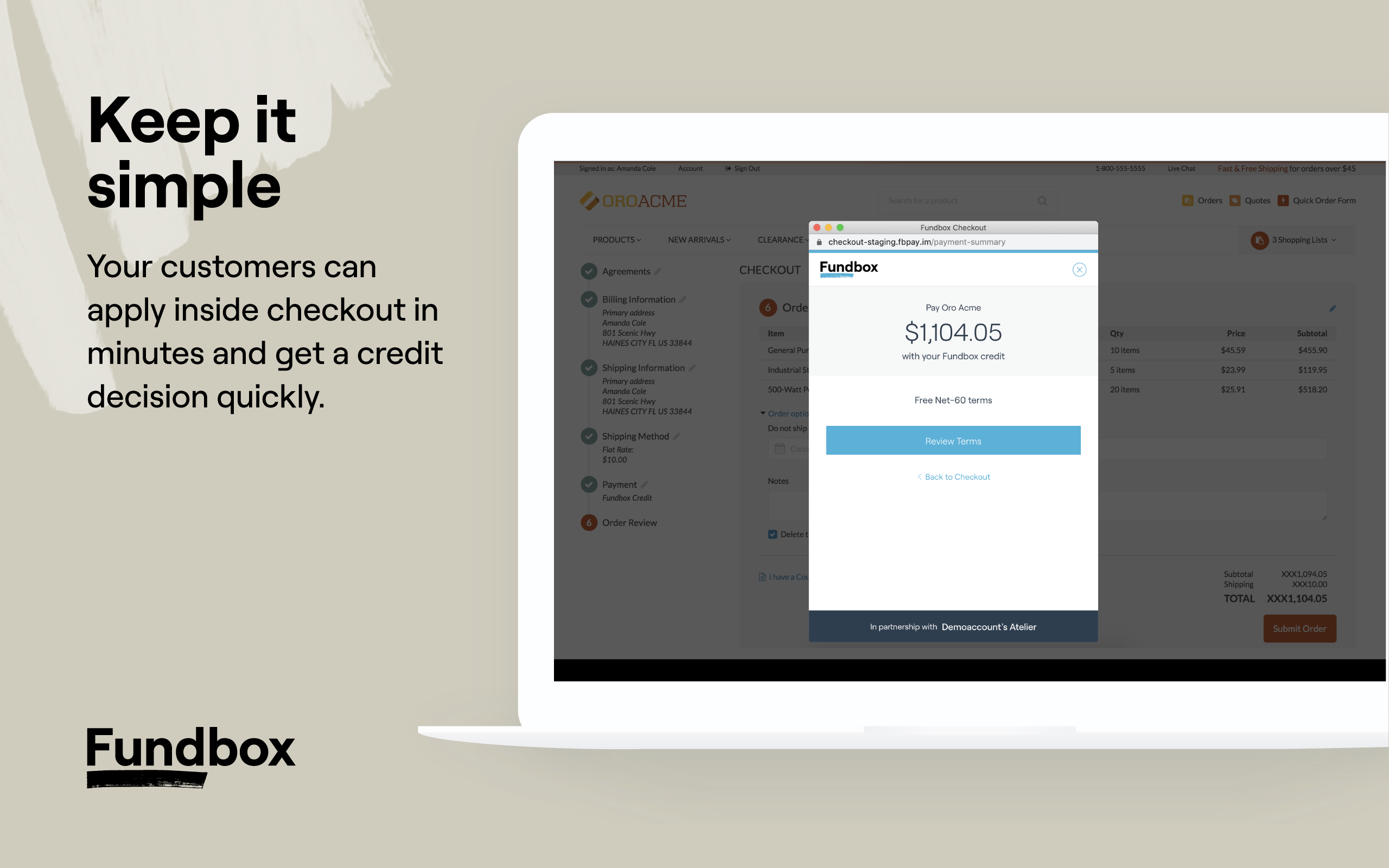

Oro: When integrated with a B2B eCommerce platform, how can a solution like Fundbox improve the customer experience at the point of checkout for B2B buyers?

Jason: This is a great question. We’ve built Fundbox around the belief that access to credit at the point of need is critical to the future of B2B e-commerce.

Think about it.

If you’re a buyer looking to purchase $50,000 in supplies and you need net terms, the faster you can qualify for credit means the faster you can move to generate revenue to pay for your purchase. And just like consumers, B2B buyers want to know in real-time what their purchasing power is and if they have the ability to pay over time without killing their cash flow.

All of this can happen for the buyer at the moment they’re most inclined to make that purchase. If they have to look for inventory in one place and then submit a credit app in another and then have to wait for a credit decision and then finally to negotiate terms, there are plenty of points along the route to purchase where buyers can just give up.

The last thing I would say is that Fundbox is already providing net terms and access to credit from within a number of platforms, including OroCommerce. When we integrate our services into a partner platform, our goal is to help businesses bridge the complexities of managing B2B payments including the ability to offer net terms and access to credit.

We also want to make sure that we build our offering around the end customer. There’s nothing less compelling then adding a service feature that distracts your customers or, even worse, forces them to leave the workflow that they’re already working in. So we keep our presence inside other platforms benign while being easy to access, convenient to use, fast to respond and always with the end customer in mind.

Closing Thoughts

Oro: Are there any final thoughts you’d like to add for companies exploring alternative payment solutions?

Jason: Well first I would like to thank you and the Oro team for inviting me to have this discussion. I have enjoyed every second of it. Now with regard to businesses exploring alternative payment solutions, “I say go for it.”

We’re well past the phase of wondering if alternative payment methods work. They do. We know it and the growth of our customer base proves that new payment systems are helping businesses to grow in ways they couldn’t have imagined before. So don’t sit by the wayside for too long.

Thanks again, this conversation was a real pleasure.