navigation

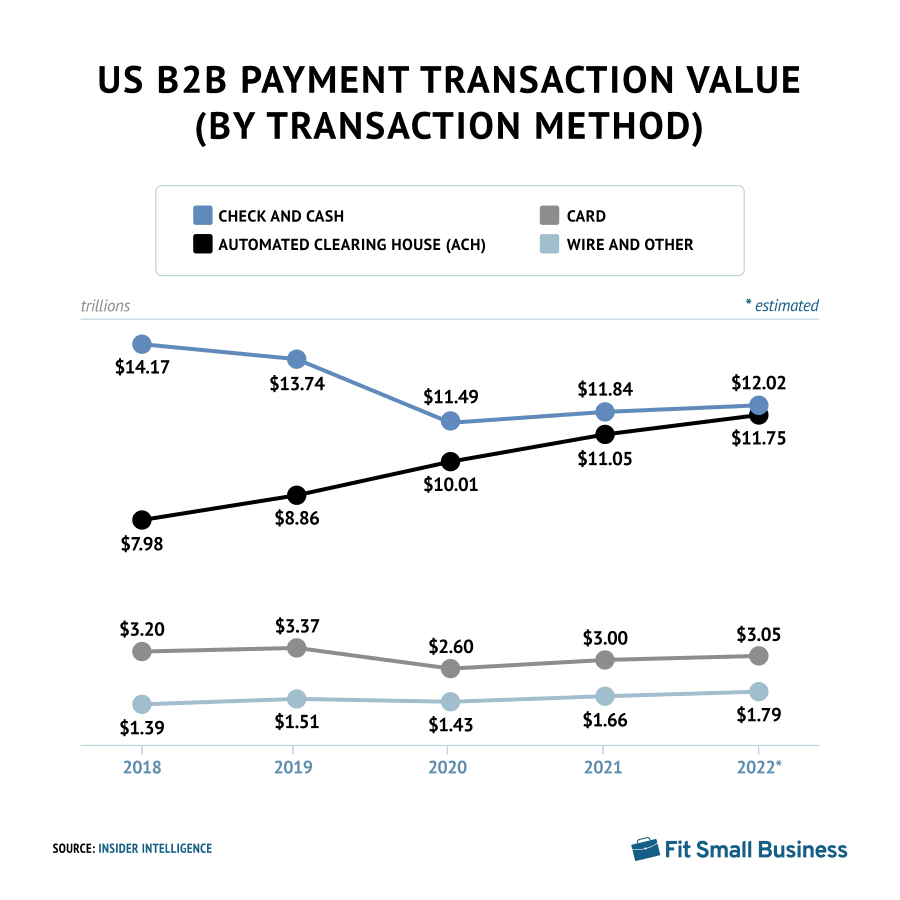

80% of B2B transactions will be digital by 2025. If Gartner’s forecast is right, it should become a matter of strategic priority for B2B businesses to consider digital commerce.

Yet, many are still reluctant to embrace online sales, not least because of the complicated payment processes, high fees, and security concerns.

In this article, we’ll dispel some myths about B2B eCommerce payment processing, and talk about B2B payment types, trends, and solutions. Want to expand your online reach with digital B2B payment options or simply curious about the benefits of online payments? Read below to find out more.

What is B2B Payment?

B2B payment, or business-to-business payments, refers to transactions between two businesses where one business pays the other for goods or services. These payments can be made through various methods, such as wire transfers, credit cards, and online payment platforms.

A B2B payment system in eCommerce is an essential aspect of any eBusiness operation, and efficient B2B payment solutions can help streamline financial processes, improve cash flow, and enhance business relationships.

The Differences between B2C and B2B eCommerce Payment Methods

In B2C retail, processing the payment is fairly straightforward. Customers don’t expect terms and are accustomed to paying when they check out. In addition to credit cards, payment gateway services allow eTailers to accept Paypal, Apple Pay, Amazon Pay, and a range of other methods.

Some forward-thinking sellers are even taking advantage of blockchain technology and accepting cryptocurrency. The risk of fraud is very real. Juniper Research estimates that B2C online retailers will lose $130 billion from card-not-present transactions between 2018 and 2023.

On the other hand, with B2B payment methods, buyers are accustomed to paying with terms that may be negotiated along with prices. It’s not uncommon for net 30 and net 60 options with discounts for early payment to be offered.

B2B customers are looking to build long-term relationships and aren’t surprised when a credit check is part of the early process of establishing that relationship.

While fraud is still a real concern when processing B2B eCommerce payments, it isn’t as prevalent as B2C fraud. Experian estimates $50 billion annually. While not a drop in the bucket, it is still a small portion of the total volume of sales.

The Most Popular Types of B2B Payments

Traditional B2B Payment Options

B2B payment options must take into account a number of factors. For example, for their own convenience, buyers may want to pay for multiple invoices at one time. In the healthcare industry, HIPPA compliance concerns must be considered.

In all industries, prices and payment terms may be negotiated on a per-customer or per-contract basis. So, payment options must be flexible. Here’s a look at the most common traditional payment options.

Paper check

According to a survey of financial professionals, it’s remains the leading payment method used in B2B: 51% of B2B payments are still made by check. The buyer issues a purchase order and the seller issues an invoice. This takes time. The average lifecycle of a B2B payment in the US is 34 days.

But even this old-fashioned process is prone to error. According to Comdata, the error rate for B2B payments is 18%. And there is a cost associated with these paper checks; anywhere from $4 to $20 per check. Even if you sell online, a B2B eCommerce platform with a flexible workflow engine will allow you to continue with traditional billing and allow your customers to pay by paper check.

ACH

Kissing cousin to the paper check is the ACH transaction. It’s like a check, but in digital form, and it has its advantages. The share of ACH transfers by value reached 69% in 2020, making it one of the most popular B2B e-payment methods.

Buyers like ACH because it is convenient. Sellers like ACH because they gain faster access to funds (often in just a day) than with paper checks and the bank processing is cheaper than with a paper check. Transactions can be initiated by the buyer or seller.

Wire Transfer

Like ACH, a wire transfer is a B2B payment method that moves money from one company’s bank account to another company’s bank account. It is as secure as delivering cash in person but much more practical.

While ACH transactions are processed in batches, wire transfers are processed individually. Wire transfers are generally used for large transactions and incur greater bank charges than paper checks or ACH.

Credit/Debit Card

Millennial buyers are already accustomed to making personal payments with a credit card for internet purchases, so they are less resistant to doing so for business purposes than their Boomer counterparts.

The higher the value of the average invoice, the less likely it will be settled by credit card. However, some buyers like plastic as it gives them the flexibility to pay on their terms. And speaking of terms, invoice financing and lines of credit have gone digital.

Nontraditional B2B eCommerce Payment Methods

In addition to traditional payment methods, B2B eCommerce payment trends indicate that nontraditional B2B online payment methods are gaining in popularity. Many of these payment methods got their start in the B2C space eCommerce and have successfully crossed over to B2B.

PayPal

If you sell to retailers, your customers may want the option of paying with PayPal. That’s because most retailers are already accepting PayPal payments from their customers and are familiar with this payment method. PayPal offers exceptional fraud protection. When you comply with PayPal’s rules for shipping, your payment is guaranteed.

AmazonPay

AmazonPay allows Amazon customers to pay on third-party sites with their pre-established Amazon payment method. For companies that do significant volume on Amazon, AmazonPay simplifies their payables processing. Instead of keeping up with a credit card or other payment credentials, employees are assigned AmazonPay access and use their familiar Amazon login to make payment. It’s becoming a popular method for internal control.

Cryptocurrency

Bitcoin, Ethereum, and LiteCoin are the most common forms of digital currency referred to collectively as cryptocurrency. These B2B online payment options aren’t backed by a government or a bank. While more secure than traditional currency transfers they do carry risk.

Why Companies Use B2B Payment Software

Are you scaring potential customers away? Today’s B2B buyer expects to have the option to complete a transaction using a payment method of their choice when they start a cart. If you don’t offer online payment options, you may be scaring potential customers off and losing sales to competitors that understand the buyers’ desire for a self-serve model.

=When you offer a variety of payment options (while upholding eCommerce PCI compliance requirements) you remove barriers to completing the sale. Successful B2B eCommerce sellers understand that increasing customer experience is all about removing barriers to a successful transaction.

Consider you are a buyer and need a new widget supplier. You jump on your tablet or laptop and start researching potential vendors. Company A has a website with beautiful photos, complete product descriptions, an online chat to help you decide the right widget for your use. Prices are competitive too. Company B also has a great website with comparable products and pricing.

You go back to Company A window and start your cart. When you get to checkout you get instructions on how to contact the company to complete your order by phone, email or fax. A little frustrated you switch back to Company B, complete a cart, checkout and are greeted with a variety of payment options. Which company will you buy from? The more payment options you provide online, the higher your conversions.

In addition to improving the customer journey, when you process payments online you can actually improve your cash flow and decrease your collection efforts.

That’s because traditional billing and payment methods often result in late payments. According to the Export-Import Bank, 60% of invoices are paid late. These late payments impact your cash flow, making it hard to pay your own bills and employees. Digital processing partners like Apruve and Fundbox offer invoice financing and invoice factoring to improve your cash flow. They can also assist with real-time credit risk processing.

When you manually check credit risk, you are open to human error and frequently end up with highly subjective decisions that are often untraceable and made by a member of the sales or finance team. Digital processing relies on objective risk assessment by the algorithm and can be adjusted as your adversity to risk ebbs and flows. It’s done in real-time, so new customers complete their transactions, get the terms they need, and you start a new relationship off on the right foot.

Trends in the B2B eCommerce Payments

Blockchain

Blockchain technology has the potential to revolutionize B2B eCommerce payments by providing greater security, efficiency, and transparency.

Blockchain technology can enable faster and more efficient payment processing, as it eliminates the need for intermediaries such as banks and payment processors. This can help to reduce transaction costs and streamline the payment process for businesses. Finally, blockchain can facilitate the use of smart contracts, which are self-executing contracts that automatically execute when certain conditions are met. This can help to automate payment processes and reduce the need for manual intervention.

Automation

By leveraging automation technologies such as robotic process automation (RPA) and artificial intelligence (AI), businesses can achieve greater efficiency, accuracy, and control over their B2B digital payments.

With automation, businesses can set up recurring payments, schedule payments in advance, and automatically reconcile payments with invoices. This helps to save time and reduce errors, as well as improve cash flow and optimize working capital. Additionally, automation can help to reduce the risk of fraud and other types of financial crime, as it eliminates the need for manual intervention in the payment process.

Buy Now Pay Later

Buy Now, Pay Later (BNPL) is a trend that has been gaining traction in B2C eCommerce, and it is now starting to make its way into the B2B space. BNPL allows businesses to purchase goods and services on credit and pay back the amount over a period of time, typically in installments. This can help businesses to manage their cash flow more effectively and reduce the strain on their working capital.

Additionally, BNPL can help to improve customer loyalty and drive sales, as it makes it easier for businesses to make purchases without having to pay the full amount upfront. While BNPL is still in its early stages in B2B eCommerce, there is growing interest in this payment option, and we can expect to see more businesses adopting this model in the future.

What Are the Challenges of B2B eCommerce Payments?

While modern commerce demands increasingly high levels of flexibility and responsiveness, the aggressive expansion and distribution of supply chains has made it more difficult to complete transactions on time. Therefore, in order to be successful, a B2B electronic payment system must first address some of today’s most vexing B2B ePayment challenges:

1. Handling multiple B2B payment options, including checks

The best eCommerce portals will make payment as easy as possible for their customers. While having the ability to handle standard credit cards and ACH payments is a given, a good online payment service should also be able to accommodate corporate and purchasing cards (or P-Cards), as well as their attendant needs.

P-Cards are becoming increasingly central to online B2B transactions, especially as more businesses continue to move away from paper. However, because B2B purchases are typically larger and more frequent than consumer credit card purchases, businesses are also looking for ways to qualify for the lowest possible Interchange rate, or the fee card-issuers charge to process a transaction. To do this, the buyer must be able to enter in detailed data about their purchase, such as product codes, descriptions, and tax amounts, so that they will meet Level 3 Interchange requirements, which offer the best possible rates.

Of course, online payment services must also be able to process other B2B payment methods, such as paper checks. Although fewer business than ever are using them (as we have previously documented), they are still integral to the B2B world. Furthermore, certain industries, such as medical and legal, still prefer checks over other forms of payment.

2. Credit lines and discounts

It has become standard for B2B sellers to offer their buyers credit and volume-level pricing, among other discounts, and these expectations have carried over into their e-commerce stores. As such, online B2B payment services, unlike their B2C counterparts, cannot require customers to simply enter in their payment information when they are done shopping. Instead, it should have the capability of saving order information and only sending out invoices as needed, even if it is several months afterward.

In addition this functionality, the payment service will need to be able to automatically track down payments, send out reminders, check customer credit, and, in some cases, retroactively apply discounts to customer orders. All of this will give the B2B customer the experience they are used to, along with the speed and convenience of an online store.

3. Purchasing approval

In B2B transactions, it has also become common for multiple buyers to be involved in an order. As a basic example, one employee may be in charge of placing the order, but will then have to somehow send that information to another employee who has the authorization to pay. In more complicated arrangements, a seller may need to take orders from multiple departments within a single company, each of which is using a different form of payment. Both of these situations can easily delay the payment process and, even worse, lead to cart abandonment.

To prevent this, a successful online payment system should be able to track and save orders, as well as give customers the ability to securely send them across departments for payment approval.

4. Security

Finally, data security remains an incredibly important concern when it comes to online payments. Especially in B2B e-commerce, where transactions are made frequently and any breaches could result in the loss of sensitive data from both the buyer and seller, it is paramount that payment systems stay safe and secure. They can do this by utilizing a tokenization solution, in which sensitive payment data is encrypted and replaced with a token, and is stored in a database safely away from the online store. Tokenization has the added the advantage of letting customers one-click order without having to enter their payment data in each time.

How OroCommerce Can Help Optimize B2B Payment Methods for Your Company

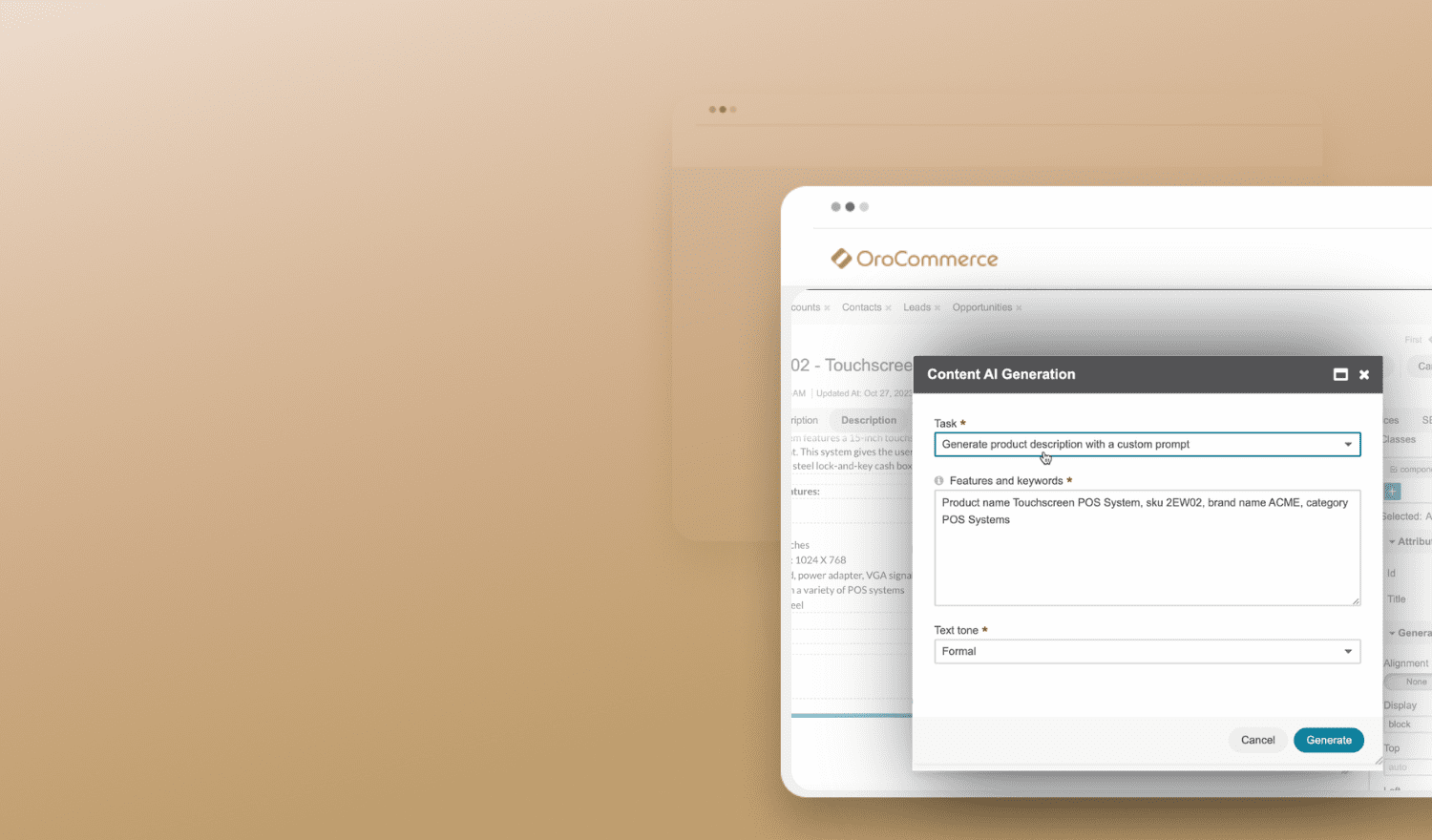

OroCommerce is an eCommerce platform that has been specifically developed to cater to the complex requirements of B2B, B2C, and marketplace businesses. Unlike other platforms, OroCommerce has been built from scratch to meet the unique needs of these businesses.

OroCommerce supports payment rules that display unique payment options to clients, separate payment terms, and payment approvals by individuals. It also supports invoices, delayed payments, and other B2B payment needs.

It offers flexible back-end and front-end APIs that can be easily accommodate various B2B eCommerce payment methods. Furthermore, OroCommerce comes with pre-built connections to some of the world’s leading systems, making it easy for businesses to get started with the platform, including Novalnet, Authorize.net, PayPal, Cybersource, and more.

Learn how Oro can help you manage B2B online payments

Summing Up

Digital purchasing experience can make or break your digital commerce initiative. For 83% of buyers, a smooth payment and checkout experience is a top priority when choosing a supplier eCommerce site to purchase from. And without diverse payment methods seamlessly integrated with a B2B eCommerce system creating top-notch experience is simply impossible.

So take the time to understand how your customers want to purchase from you, attune to their needs with suitable B2B payment solutions, and start benefitting from higher conversions and greater internal efficiencies.

Frequently Asked Questions

How to choose a global payments platform?

Choosing a global payments platform can be a daunting task, but there are several key factors that businesses should consider to ensure they choose the right platform for their needs.

- Coverage: Businesses should choose a platform that supports the currencies and payment methods they need to operate in their target markets.

- Security: A platform should provide robust security features such as encryption, fraud detection, and compliance with industry standards and regulations.

- Integration: The platform should be easy to integrate with the business’s existing systems and processes.

- Cost: The cost of the platform is another important consideration. Businesses should choose a platform that offers transparent pricing, with no hidden fees or charges.

- Support: Finally, businesses should choose a platform that provides reliable support and customer service. This can help to ensure that any issues or concerns are addressed promptly and efficiently.

What payment method is most commonly used in B2B eCommerce?

The most commonly used payment method in B2B eCommerce is electronic funds transfer (EFT) or wire transfer. This involves transferring funds directly from one bank account to another.

Other common payment methods include credit cards, debit cards, and purchase orders. However, the specific payment method used may vary depending on the industry, region, and individual business preferences.

Which is the best B2B payment platform?

The market most trusted B2B online payment platforms are:

- PayPal

- Authorize.net

- Stripe

- Amazon Pay

- 2Checkout