“The only constant is change” – Heraclitus said back in 450 BC. It was as true then, as it is today. Whether it’s B2B or B2C, business is changing. To help you keep up, we’re taking a look at challenges faced by different industries. We’ll assess the state of the industry, highlight key trends, and show where digitizing will give you a competitive edge. Today we start with the furniture industry.

The State of Furniture Industry

The outlook for the furniture industry is bright as the furniture market has been growing steadily since 2009. Sales in the furniture and home furnishings sector in the US alone are projected to increase 19.6% by 2020 totaling $122 billion. In 2015, the furniture industry was outperforming the economy as a whole at a rate of 2 to 1. This positive growth trend is expected to continue with strong support from sales in the bedroom and dining room departments. 2017 was a year for increased production and revenue for furniture manufacturers. In addition, furniture store sales continue to outpace other retail sectors.

Major Trends Shaping the Market

Although the furniture sector is growing, players should be aware of trends that are influencing growth. We see 5 major trends that are shaping the market now and will continue to exert major influence in the coming years.

Millennial buyers

Starting in 2014, there began a significant shift in customer behavior driven by the entrance of the millennial buyer. Millennials represent 37% of the consumer furniture and bedding market and are known to represent an astounding 46% share of all the B2B buyers. And while Baby Boomers continue to represent the largest percentage of dollars spent in the furniture market, millennials make up the largest percentage of buyers in the market. Between 2012 and 2014 millennials increased their spend on furniture and bedding by 142%. Millennials are technology-savvy buyers. They rely heavily on web searches for alternatives to the items they see in physical stores. Before making a purchase, they use the web to find product reviews and make brand comparisons.

RTA design

Ready-to-Assemble (RTA) furniture has been around since the mid-1800’s but has recently become a popular alternative to assembled furniture. As quality increases and global brands like Ikea gain recognition, buyers are flocking to RTA furniture. That’s good news for furniture manufacturers. The production process cost less, is simplified, and shipping is easier. Retailers require less warehouse space to store the same amount of inventory. RTA furniture will continue to be popular with buyers.

Office furniture and luxury furnishings

Versatile home office furniture and high-end furnishings are other segments that demonstrate steadily increasing consumer demand. For example, global home office furniture purchases are projected to grow by a compound annual growth rate (CAGR) of nearly 6% between 2014 and 2019. The luxury vertical is expected to grow at a CAGR of 4% in the next two years. Furniture companies that are considering product expansion should explore these lines.

Ergonomic design and eco-friendly materials

Reusable, eco-friendly furniture is in high demand from dedicated environmentalists and conventional buyers alike. By taking a ‘green’ approach to furniture manufacturing and using of recyclable materials, furniture makers fill the consumer need for sustainable living. Businesses are looking to acquire ergonomic pieces too, as ‘green’ trend is often used to make their employer brand more appealing.

Moving furniture online

Furniture has been traditionally sold from physical stores with expansive showrooms. That’s not necessarily the model for the future. Millennial buyers prefer to buy from a retailer that allows them to shop online from the comfort of home. Some furniture stores were early adopters but didn’t fully understand the model. Just a few years ago 88% of furniture stores had a website, but only 30% were actually selling online. These days, an effective online presence must fully digitize commerce, not just act as an online display. eCommerce is a must.

Furniture Industry Challenges: Putting the Pieces Together

To be successful you must not only give millennial and boomer buyers the products they want, you must offer the shopping experience they want. A website that simply represents your brand or provides your contact info won’t do. Customers need to be able to search and view your product range online and place orders without leaving the discomfort of the couch they are replacing. Then they need follow-up communication and offers for additional products. At the same time, you need a back-end that integrates with your ERP for production purposes.

Digitizing for sales

eCommerce websites are perfect for delivering the RTA products consumers want. Production and shipping costs are lowered and buyers get the self-serve experience they want. A digital store without a physical retail store provides the buying experience today’s consumers demand.

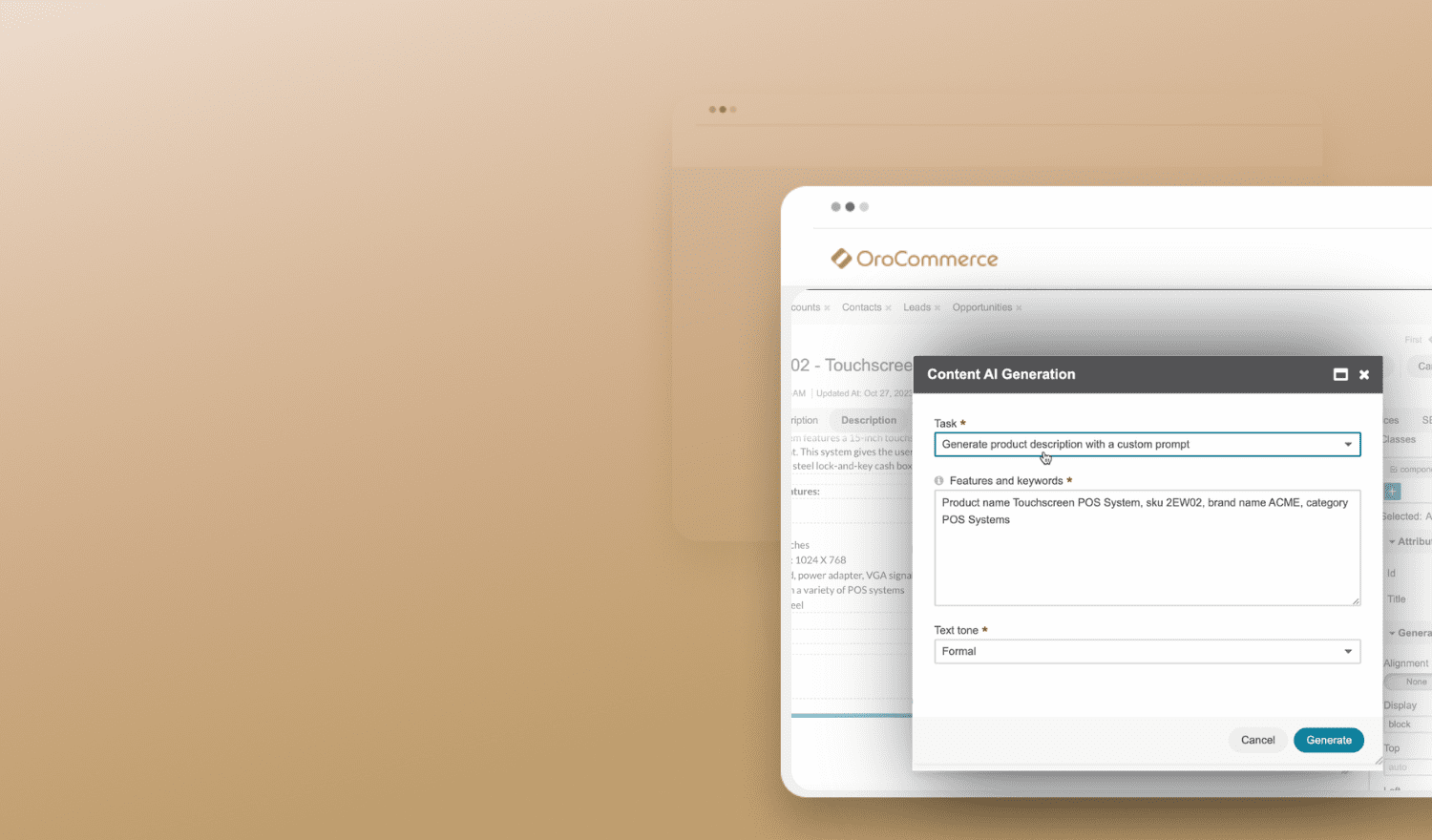

To be effective, this online sales channel should deploy technologies that facilitate and streamline the selling processes while gathering insightful, aggregated customer data. Whether you are a B2C or a B2B furniture seller, an eCommerce platform integrated with a CRM is your game-changing tool if you want to be an industry trend-sensitive company. Integrating both business applications allows you to start selling quickly for fast ROI while controlling all sales channels.

Digitizing for operations

Furniture manufacturing and supply can be complex. Not only must you maintain customer relationships, vendor relationships are vital as well. An ERP system is vital for managing production, inventory, and orders. It allows planning furniture production with minimum delays, control manufacturing floor, and back-office operations, as well as manage inventory and logistics.

Picking a partner

E-Commerce and CRM technology represents more than an investment in monetary resources. It is an investment in growing your business. Important factors to consider are the ability to support true B2B e-Commerce, the total cost of ownership, available support, partner ecosystem, flexibility, and scalability. It’s not a decision to be made lightly. Fortunately, market analysts are always providing their opinions. In the most recent research by Frost & Sullivan, they share their take on key vendors within the B2B eCommerce platform market and provide a detailed product comparison.

So as you see, the future for the furniture industry is bright for the companies that are able to spot trends, adapt to changing market demands, and digitize to increase sales and profitability. The only question remaining is what kind of future will you build?